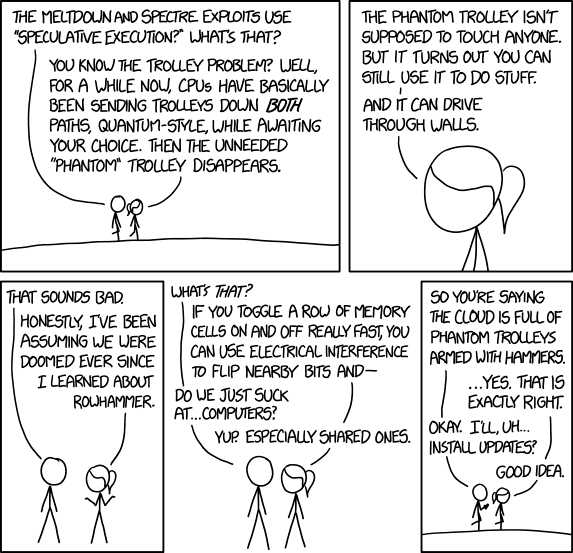

Major Intel CPU vulnerability

-

-

Our database vendor just reached out to tell us that 10-15% is the measured impact for our database.

-

@scottalanmiller said in Major Intel CPU vulnerability:

Our database vendor just reached out to tell us that 10-15% is the measured impact for our database.

That's substantial...

-

@scottalanmiller said in Major Intel CPU vulnerability:

Our database vendor just reached out to tell us that 10-15% is the measured impact for our database.

So does it affect performance only “after” it’s been patched?

-

-

@danp said in Major Intel CPU vulnerability:

Not surprising, unfortunately there is no way that they wouldn't be sued. If a patch has been developed this quickly, then there is clearly something majorly broken, but easily remedied.

-

@fredtx said in Major Intel CPU vulnerability:

@scottalanmiller said in Major Intel CPU vulnerability:

Our database vendor just reached out to tell us that 10-15% is the measured impact for our database.

So does it affect performance only “after” it’s been patched?

Yes

-

-

Good article about how the likes of Vultr, Digital Ocean, Linode, and others are working together to try and solve the issues this creates. Sounds like they learned same time we did.

-

@zachary715 said in Major Intel CPU vulnerability:

Good article about how the likes of Vultr, Digital Ocean, Linode, and others are working together to try and solve the issues this creates. Sounds like they learned same time we did.

Which means Intel wasn’t disclosing to key vendors.

-

From my reading, they were disclosing to the big boys at Amazon, Microsoft, Google, but not to these other guys. So now they're scrambling.

I guess in reality you can't really reach out to EVERYONE affected immediately. You have to draw the line somewhere of who knows ahead of time and who doesn't. I just would have thought some of these providers were large enough to justify disclosure

-

@zachary715 said in Major Intel CPU vulnerability:

From my reading, they were disclosing to the big boys at Amazon, Microsoft, Google, but not to these other guys. So now they're scrambling.

Right, and that's what I think is terrible. Some customers (not us) get to know about security problems and we (and likely most of our vendors), do not. It's Intel's right to treat some customers like total shit, and it's our right to see them as dishonest pieces of crap that I don't trust at all.

-

@zachary715 said in Major Intel CPU vulnerability:

I guess in reality you can't really reach out to EVERYONE affected immediately.

Yes, you can. And they decided that they had other priorities that didn't involve their customers. They were focused on trying to hide as much as they could, for as long as they could; rather than being honest and doing the right thing.

And they totally screwed a lot of customers, big and small. They made it extremely clear that only the very biggest, most powerful companies that could sue the crap out of them get the "best" security protection. Everyone else is thrown to the wolves.

-

@zachary715 said in Major Intel CPU vulnerability:

I just would have thought some of these providers were large enough to justify disclosure

There is an easy guide for where to draw the line - anyone who purchased an Intel CPU was big enough to have gotten the flaw, and therefore had a right to know the instant Intel found out. Intel has an ethical, and hopefully legal, obligation to have informed their customers that they were (and are) at risk. Knowing that there was this risk and intionally hiding it should have major legal ramifications, beyond the financial ones.

There might be a time where it is okay to find a security hole and try to patch it. But once you are telling SOME customers, and not others, you've crossed a serious line.

For example, what if one of the big customers that they told was the NSA or the Russian or Chinese government, or some hacker group, a malware vendor, or anyone who has employees that aren't 100% trusted? These are big vendors with hundreds of thousands of employees to which this was disclosed. And we know that it was leaked to the public. That means that the bad guys knew before it went public.

I think that people are overlooking how insanely bad and anti-secure it is to pick a few giant companies to tell, but not others. It's not just that Intel likes those few and doesn't like the others. It's that Intel actively disclosed to a few companies how they could hack all of Intel's other customers.

Intel forced all of us to trust not only Intel (whom I no longer trust) but anyone that Intel trusted without telling us that they were selling out our security secrets.

-

Think of it another way, imagine if Intel made door locks. They discover that there is a way to unlock the doors without the key. They then call a bunch of your competitors and tell them about how your doors can be bypassed without you knowing.

That's exactly what Intel did. They sold the security secrets of the many, to a few partners with the deepest pockets. As far as I'm concerned, people should be going to jail over this.

-

@storageninja said in Major Intel CPU vulnerability:

It takes 3 seconds to look at his stock trades and see the pattern, and another 5 minutes to see that he filed paperwork for this plan back in 2015

At the end of Q4 he sells his awards. Nothing to see here fake news from the internet mob who's too lazy to learn basic finance skills.

You sure about those details?

-

Pretty cut and dry insider trading, I wonder how much of hiding this flaw from the public was solely to hide the insider trading?

" To avoid charges of trading on insider knowledge, executives often put in place plans that automatically sell a portion of their stock holdings or exercise some of their options on a predetermined schedule, typically referred to as Rule 10b5-1(c) trading plans. According to an SEC filing, the holdings that Krzanich sold in November — 245,743 shares of stock he owned outright and 644,135 shares he got from exercising his options — were divested under just such a trading plan.

But Krzanich put that plan in place only on October 30, according to the filing. "

-

@scottalanmiller said in Major Intel CPU vulnerability:

@storageninja said in Major Intel CPU vulnerability:

It takes 3 seconds to look at his stock trades and see the pattern, and another 5 minutes to see that he filed paperwork for this plan back in 2015

At the end of Q4 he sells his awards. Nothing to see here fake news from the internet mob who's too lazy to learn basic finance skills.

You sure about those details?

It very well may not be the case... I mean, 5 minutes and 3 seconds of research is barely anything.

-

Of course, Intel is the same vendor that sells the majority of the world's FakeRAID. So what do we really expect?

-